Support Us

The Ripple Fund

Community Foundation of Anne Arundel County Donor Advised Fund

About the Organization

Established in 2023, The Ripple Fund is a Donor Advised Fund at CFAAC created to support the philanthropic interests of its advisors. The fund aims to create "ripples of change" in areas where the advisor has both personal passion and connection. It focuses on driving meaningful impact across four key areas:

- The advancement and empowerment of women

- Supporting veterans

- Aiding immigrants

- Promoting the healing power of music

A Message from The Ripple Fund

Created in 2023 by HD Enterprises’ co-founder Nicole Hassannia, The Ripple Fund was born to create “ripples of change” in areas where she has both passion and a personal connection. This charitable fund is designed to drive meaningful change across four primary areas of focus: (1) the advancement and empowerment of women, (2) supporting veterans, (3) aiding immigrants, and (4) fostering the recognition of the healing power of music.

Managed by The Community Foundation of Anne Arundel County, The Ripple Fund is funded by a combination of self-funding and the generous financial (and time) contributions of others. Since its inception, the fund has already made meaningful impacts to individuals in the community.

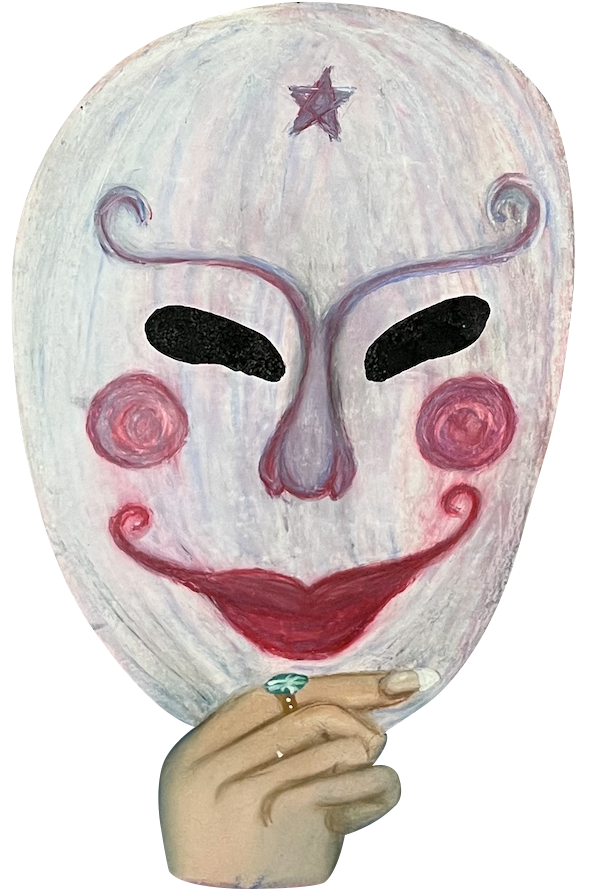

The impetus for the creation of The Ripple Fund was Nicole’s desire to help others see their potential and learn how to love themselves. She survived years of emotional and physical abuse and knows that it is possible to overcome trauma and rebuild a healthy, confident, and thriving life. Nicole often masked this hurt to the outside world—hence The Ripple Fund’s hand drawn logo of a mask. It was drawn by Nicole in childhood for a school art project, seeking to cover the pain and hurt she was experiencing below the surface. Now, Nicole leverages The Ripple Fund as one way to help others discover a healthy and thriving life.

Key Areas of Focus

Advancing and supporting women has always been central to our mission. From the start, The Ripple Fund has empowered women by removing barriers to their success. One example is Starr, who regained her confidence after we helped repair her chipped tooth. Today, the Fund continues to propel women forward, amplifying their voices and creating opportunities for future generations, like Nicole and her daughters. We focus on the future, embracing women’s unique strengths to uplift themselves and their communities. We’re always seeking new ways to make an impact—if you have ideas, let us know!

Many veterans and active service members often go unrecognized for their sacrifices. Nicole and her husband Jeff, a veteran and owners of Aerospace BD, understand this firsthand. The Ripple Fund supports organizations that assist with transitioning to civilian life, financial education, counseling, and rehabilitation, ensuring donations directly help veterans. For example, the Fund supports programs providing service dogs, which offer emotional support, help with PTSD, and assist with everyday tasks, significantly improving veterans’ lives.

America thrives on its foundation of opportunity, where immigrants can work hard, speak freely, and practice their beliefs in safety. Immigrants are eager to contribute but often need support like language training, vocational schooling, and financial literacy. The Ripple Fund seeks to provide this support, helping immigrants integrate into the workforce, build careers, and strengthen the economy. Empowering them creates a brighter future for all.

Music has the power to inspire, heal, and transform lives. The Ripple Fund supports initiatives that use music to promote physical and emotional healing. Music reduces pain, stress, and tension, enhances the immune system, and improves sleep. It also aids neurological recovery and helps process difficult emotions, boosting mood and well-being. Join us in making a lasting impact. Explore our initiatives and partner with us to create change. If you have an organization focused on these areas, reach out today!

Make a Tax-Smart Impact

Many people like you are making tax smart donations with appreciated stocks and bonds, qualified charitable distributions (QCD) from an IRA, or a variety of planned gifts. For more information, please email John@CFAAC.org or call 410-280-1102 ext. 103.

Should you wish to make a non-cash donation, CFAAC accepts gifts of appreciated stock for the benefit of this fund. To initiate this transaction, contact your broker with the number of shares of each security you wish to give. All gifts of stocks and bonds which are “DTC Eligible” can be transferred to CFAAC using the information below:

- Pershing, LLC Depository Trust Company (DTC) #0443 For the credit to: Pershing, LLC #4S2117401

- Account name: The Community Foundation of Anne Arundel County

PLEASE NOTE: Donor names are rarely provided when securities are transferred electronically. To ensure your gift is correctly allocated, please email Kathy@CFAAC.org with the gift amount and the name of the fund your gift will support.