Endow Maryland

A Maryland state tax credit called Endow Maryland rewards donors who help build permanent charitable funds for local communities across the state and in Anne Arundel County. Endow Maryland offers a tax credit for gifts from $500 – $50,000 to permanent, endowed funds at qualified community foundations in Maryland.

For more information, contact John Rodenhausen at John@cfaac.org or call 410.280.1102, ext. 103.

Community Benefit

Endow Maryland provides an incentive for Marylanders to give back to their local communities in a meaningful and lasting way. It promotes philanthropic giving in Maryland, for Maryland.

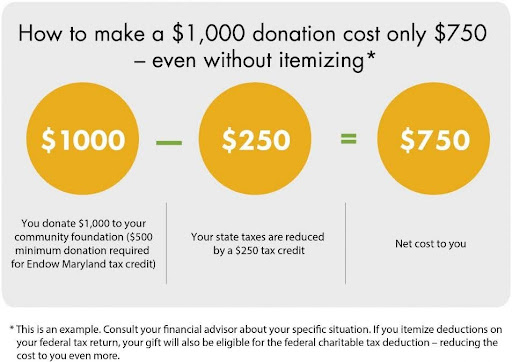

Endow Maryland tax credits can be used to support permanent charitable funds at the Community Foundation of Anne Arundel County (CFAAC) that allow us to address Anne Arundel County’s greatest needs today and for generations to come. Your gifts to establish or add to an existing endowed fund at CFAAC may qualify for a 25% tax credit on your 2025 tax return. CFAAC has a limited number of tax credits available, donate today.

Permanence

The Endow Maryland tax credit applies only to gifts to permanent, endowed funds at qualified Maryland community foundations. These gifts will generate many times the initial value of the gift and benefit Anne Arundel County forever.

To make a donation as part of the Endow Maryland tax credit program please contact our Director of Gift Planning, John Rodenhausen at 410.280.1102 x 103 or via email at john@cfaac.org.