Fund for Anne Arundel

The Fund for Anne Arundel

Addressing Unmet Needs and Building a Thriving Future Through CFAAC's Ongoing Commitment to Community Well-Being

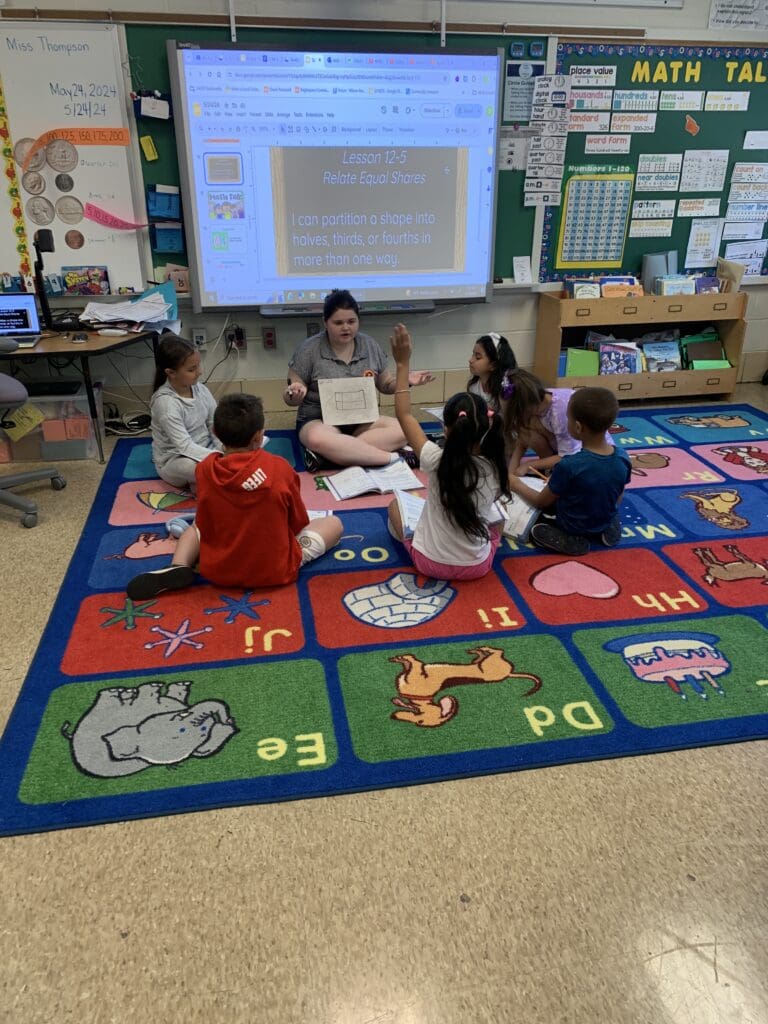

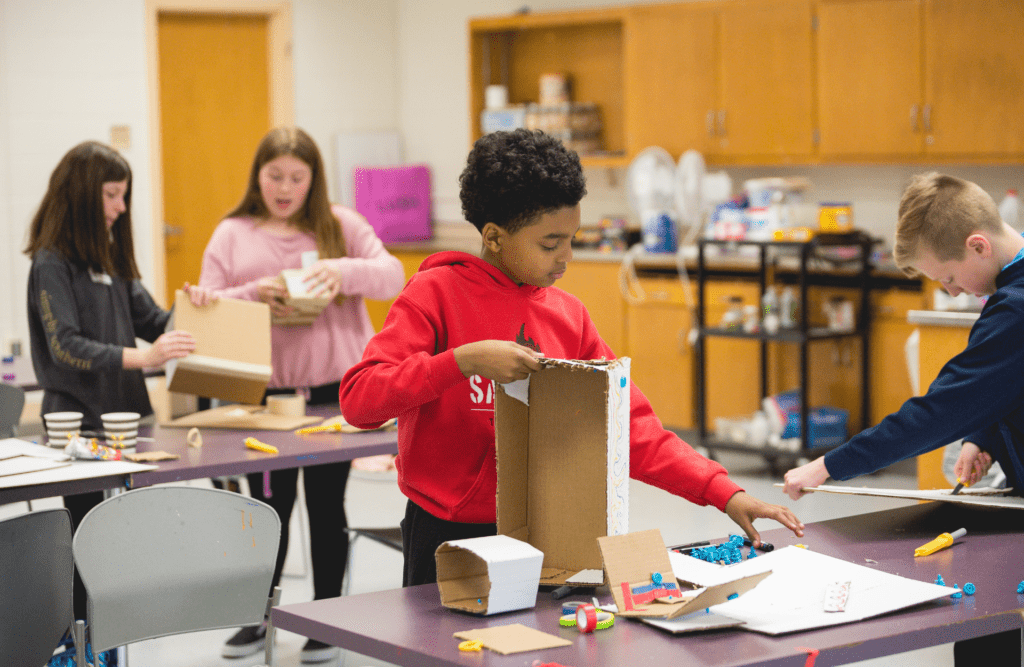

In 2025, CFAAC’s Fund for Anne Arundel awarded over half a million dollars — the most ever granted through the Fund — to 13 nonprofits serving Anne Arundel County residents. This record-breaking level of giving enabled CFAAC to not only increase overall funding but also expand the Fund’s focus to organizations prioritizing the physical, mental, and behavioral health of children and families; homeless prevention; mental wellness; and school and after-school programs.

The grants allow the following organizations to continue their vital programs and launch new initiatives to better serve all residents of Anne Arundel County:

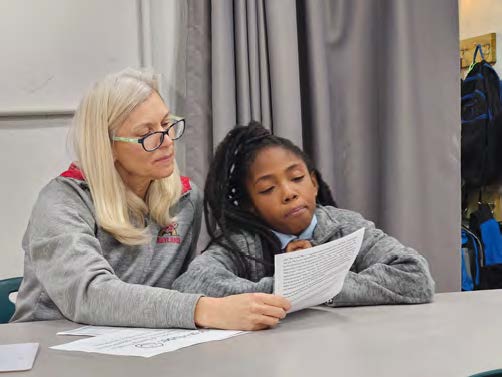

Annapolis Immigration Justice Network, Arundel Lodge, Inc., Chase Your Dreams Initiative Inc., Encore Creativity for Older Adults, HOPE For All, Joy Reigns Lutheran Church, Partners in Care, Seeds 4 Success, Inc., Start the Adventure in Reading (STAIR) – Annapolis, Inc., The Complete Player Charity, The Light House Homeless Prevention Center, Together WE Rise, Inc., and Wellness House of Annapolis.

The Community Foundation of Anne Arundel County’s Fund for Anne Arundel, continues its focus on healthy, thriving, successful children, by awarding grants to programs that address the needs of children and families. There are tremendous unmet needs that remain consistent in Anne Arundel County (AAC) as outlined in the Community Foundation of Anne Arundel County’s (CFAAC) 2022 Community Needs Assessment, Poverty Amidst Plenty VII: Moving Forward Together. The Fund for Anne Arundel was established to offer flexible and dynamic support to nonprofits doing vital work to address the most pressing needs of Anne Arundel County residents.

Children represent the future of our community, and their well-being is a direct reflection of our collective values and priorities. The state of child welfare in Anne Arundel County presents both significant challenges and opportunities for meaningful impact.

Anne Arundel County’s Children- Determined, Hopeful, Focused, Empowered

The Community Foundation of Anne Arundel County is dedicated to working with donors who wish to make an impact through their philanthropic support. A gift made in support of the Fund for Anne Arundel will be combined with the generosity of others to have a true and lasting impact on the lives of children in Anne Arundel County.

Fund for Anne Arundel History

One of CFAAC’s primary goals is to increase the dollars that the foundation has available to strategically align grantmaking with the most critical needs in the county. The Fund for Anne Arundel is a fund created to help meet critical needs and improve the quality of life for all county residents, now and in the future.

As federal, state, and local funding to support nonprofits continues to decline for countless reasons, individual donors and community foundations are being called on to fill the gaps so that nonprofits can continue to provide essential community services.

In 2017, CFAAC was awarded a $300,000 Challenge Grant from the Deerbrook Charitable Trust to begin building the Fund for Anne Arundel. In 2018, CFAAC Board Trustee Jim Humphrey added another $150,000 to the challenge, which effectively turned this opportunity into a 3:1 match. Fueled by this matching challenge, CFAAC quickly raised over $600,000 to support the Fund for Anne Arundel. As of 2024, the Fund for Anne Arundel has raised $2.51 million.

How to Apply

Fund for Anne Arundel was established to address the greatest needs in Anne Arundel County. Thanks to increased funding, in 2025, the Fund for Anne Arundel will provide grants dedicated to each of the following categories:

- Physical, Mental and Behavioral Health of Children

- Mental Wellness Programs and Initiatives

- Homeless Prevention Programs and Initiatives

- School and After-School Programs

Fund for Anne Arundel will award grants between $25,000 and $50,000 each. Applicants have the option of requesting either a one-year grant or a renewable grant of up to $25,000 per year for two years. If awarded, the grantee will be required to submit a report on the success of the first year’s program in order to receive the second year’s funding. Successful applicants will provide an explanation of how the extended timeline will allow for a more successful, sustainable program.

Successful grant applicants will demonstrate:

- Strategic and data-informed solutions, aligned with community needs and your organization’s mission

- Innovative or creative solutions with replicable models

- A successful track record in service delivery

- Credibility in the field or project

- An established sustainability plan

- The ability to collaborate in a way that provides greater leverage for philanthropic investments

- The ability to create a measurable impact through evidence-based and evidence-informed services and support

Guidelines/Recommendations for a strong application:

- The review committee is a diverse group of caring community leaders, with varied knowledge of and experience with your organization. Avoid using industry-specific abbreviations and acronyms, and provide sufficient context and background for anyone unfamiliar with your organization.

- The application is structured to provide background about your organization and the specific project proposed. Please ensure that you’re answering the specific question asked, as that will build the reader’s understanding in the most consistent and logical format. Make sure you clearly explain how you specifically plan to use this grant funding.

- We typically receive many more applications for this grant than we are able to fund. The strongest applications are those that build a compelling case for the ability to utilize the funding in an efficient and impactful way, with appropriate management and oversight in place.

Programs for which the grant will apply must be used to serve only Anne Arundel County residents. An organization may file only one application. To be eligible to apply, organizations must also meet all of the following criteria:

- Located and operating in Anne Arundel County, Maryland

- Have a 501(c)(3) tax-exempt designation from the Internal Revenue Service that has been active for 2 years as of January 1, 2025.

- Be in good standing with the Maryland Department of Assessment and Taxation

- Be in compliance with the Maryland Secretary of State Charitable Organization Registration Requirements

Prior CFAAC grant recipients may apply, however, they must have completed all follow-up reports by the required deadline. If there are funds remaining from the prior grant, the nonprofit must provide an explanation of what percentage is uncommitted and why, and the relation to the program for which they are applying now.

TIMELINE:

- Grant applications typically open in early spring and remain open for approximately five weeks.

In 2025, the Fund for Anne Arundel awarded more than $500,000 to local nonprofits supporting education, economic stability, health, and basic needs for Anne Arundel County residents.

- Following the application period: The Fund for Anne Arundel Committee will review submissions, select finalists, and conduct interviews. Grants are awarded at the conclusion of this review process.

- The funding period generally runs from July 1 through June 30 of the following year.

- Note: A mid-year and final evaluation assessing project outcomes is required within six weeks of project completion. Report formats will be provided.

QUESTIONS: See www.cfaac.org under “Apply: For Nonprofits: Grants”, or email/call Rosalind Calvin at rosalind@cfaac.org/410-280-1102 x104.

Make a Tax-Smart Impact

Many people like you are making tax smart donations with appreciated stocks and bonds, qualified charitable distributions (QCD) from an IRA, or a variety of planned gifts. For more information, please email John@CFAAC.org or call 410-280-1102 ext. 103.

Should you wish to make a non-cash donation, CFAAC accepts gifts of appreciated stock for the benefit of this fund. To initiate this transaction, contact your broker with the number of shares of each security you wish to give. All gifts of stocks and bonds which are “DTC Eligible” can be transferred to CFAAC using the information below:

- Pershing, LLC Depository Trust Company (DTC) #0443 For the credit to: Pershing, LLC #4S2117401

- Account name: The Community Foundation of Anne Arundel County

PLEASE NOTE: Donor names are rarely provided when securities are transferred electronically. To ensure your gift is correctly allocated, please email Kathy@CFAAC.org with the gift amount and the name of the fund your gift will support.